You know what they say, “to travel is to live”.

But, sometimes life can throw us curveballs. That’s why we need to talk about something that’s not just a good idea, but a great idea: travel insurance.

We’ll go over why you need to have travel insurance (and yes, it is a need), what to look for when booking travel insurance, the cost, and which travel insurance company I like best.

So buckle up, grab a cup of joe, and let’s dive into the nitty-gritty of choosing the perfect travel insurance for your next adventure.

Understanding Travel Insurance: What’s the big deal?

Travel insurance is like a safety net for those “oops” moments on the road, providing you with that extra layer of protection when the unexpected occurs.

It covers a wide range of mishaps, from medical expenses to trip interruption coverage and cancellations, giving you peace of mind so you can focus on enjoying your adventure.

Imagine: you’re having the time of your life in Thailand, sipping on fresh coconuts and soaking up the sun. Suddenly, you catch the infamous “Bangkok belly” (yeah, it’s a real thing) and end up bedridden in a local hospital.

Without travel insurance, you could be facing astronomical medical bills that might take a serious toll on your savings.

But with the right coverage, your travel insurance swoops in like a superhero to save the day, taking care of your medical costs and even medical evacuation if needed.

The importance of travel insurance isn’t limited to just health-related incidents. Picture this: you’ve spent months planning a once-in-a-lifetime trip to see the Northern Lights, only to have a pesky volcanic eruption ground your flight.

If you don’t have trip cancellation coverage, you could be out of pocket for all those non-refundable, pre-paid expenses, leaving your wallet feeling lighter and your heart heavier.

But with a solid travel insurance policy, you can wave goodbye to those financial losses and say hello to trip cancellation benefits!

And let’s not forget other unforeseen situations that can put a damper on your travel plans, such as lost luggage, stolen personal belongings, or even emergency evacuations due to natural disasters.

The financial consequences of not having travel insurance can be staggering, and could potentially leave you stranded in a foreign country with a mountain of expenses to deal with.

In short: travel insurance is your trusty sidekick on your solo adventures, stepping in when you need it most and ensuring that health or financial setbacks don’t derail your travel plans.

So, when it comes to hitting the road and exploring our beautiful planet, having the right travel insurance coverage is not just a big deal – it’s an essential part of being a savvy solo traveler.

Assessing Your Travel Needs: Putting the ‘I’ in Itinerary

Choosing the right policy is like picking the perfect travel companion – it needs to match your vibe, complement your unique needs, and be there for you through thick and thin.

To find your insurance soulmate, start by asking yourself some essential questions about your upcoming adventure:

Destination considerations: Are you heading to a tropical paradise prone to hurricanes or a region with political instability? Does your destination have a higher risk of bad weather, natural disasters, or health concerns? Research your destination to ensure you’re aware of potential risks and can select a policy that covers those specific scenarios.

Duration of the trip: Are you embarking on a quick weekend getaway or a months-long journey? Your travel insurance policy should reflect the length of your trip, as some plans offer short-term coverage, while others cater to long-term travelers.

Activities planned: Are you a thrill-seeker planning to bungee jump in New Zealand or more of a chill-seeker looking to unwind on a beach in the Maldives? Some policies might exclude coverage for high-risk activities, so make sure your plan covers any adrenaline-pumping escapades you have in mind.

Personal health and medical conditions: Do you have pre-existing medical conditions that may require special attention or treatment during your trip? Be honest with yourself about your health needs and ensure your travel insurance policy provides adequate coverage for any potential medical situations that may arise.

Travel frequency: Are you a one-and-done traveler, or do you have wanderlust running through your veins? If you’re a frequent flyer, you might want to consider an annual multi-trip policy that covers all your adventures within a year, ultimately saving you time and money.

By taking the time to assess your travel needs, you can find a travel insurance policy that fits like a glove, giving you peace of mind and the confidence to embrace your solo adventures wholeheartedly.

And for more tips on planning the perfect solo trip, don’t forget to check out my article on how to plan the perfect solo trip – it’s packed with useful insights and advice to help you make the most of your journey!

What Are the Must-Haves in Any Travel Insurance Policy?

When it comes to what to look for in a travel insurance policy, it’s essential to have a policy that’s got your back – just like a trusty traveling companion.

Here are the must-haves to look for in any travel insurance policy, so you can travel with peace of mind knowing you’re covered for those unexpected twists and turns.

- Medical coverage: A good travel insurance policy should cover medical expenses, just like a superhero ready to swoop in when you need it most. Think emergency room visits, hospital stays, and even prescriptions. Trust me, as someone who once had a surprise bout of food poisoning in Mexico, you’ll appreciate having medical coverage in your corner.

- Emergency evacuation: Whether it’s a natural disaster, political unrest, or a medical emergency, having coverage for emergency evacuation is a game-changer. It can save you from being stranded in a precarious situation, and it’s something SafetyWing, one of my go-to providers, excels at.

- Trip cancellation and interruption: Life happens, and sometimes plans change at the last minute. Look for a policy that covers trip cancellations or interruptions due to a covered reason, like severe weather or a family member’s illness. You’ll be grateful for this feature when a hurricane puts your Caribbean cruise on hold.

- Baggage delay and personal effects coverage: Lost or delayed luggage is a travel nightmare we all dread. A solid travel insurance policy should include coverage for baggage delay, as well as reimbursement for personal possessions in case they’re lost, stolen, or damaged.

- Travel delay coverage: Flight delays and cancellations can leave you stranded and frustrated. The right travel insurance plan will have you covered for additional travel expenses incurred due to these unexpected hiccups.

- Rental car protection: Planning to hit the open road with a rental car? Make sure your travel insurance policy includes coverage for rental cars, so you don’t end up paying through the nose for damages or an accident.

- Accidental death and dismemberment: Nobody wants to think about it, but accidents can happen. Look for a policy that includes coverage for accidental death or dismemberment to ensure your loved ones are taken care of if the worst should happen.

- 24/7 assistance services: When you’re in a bind, the last thing you want is to be put on hold. A top-notch travel insurance provider, like SafetyWing, offers round-the-clock assistance services, so you can get help when you need it, no matter where you are in the world.

Remember, your travel insurance policy should be as unique as your travel plans. So, make sure to tailor your coverage to suit your specific needs and tick off these must-haves.

With a comprehensive travel insurance plan in place, you can hit the road with confidence and focus on making memories, knowing you’ve got financial protection from any unexpected surprises that might come your way.

How much does travel insurance usually cost?

Well, it depends.

The price of travel insurance varies depending on several factors, such as the provider, coverage level, length of the trip, destination, and the age of the traveler.

In general, you can expect to pay anywhere between 4% to 10% of your total trip cost for a comprehensive travel insurance policy.

For example, if your trip costs $3,000, your travel insurance could range from $120 to $300. However, keep in mind that this is just a rough estimate, and the actual cost can differ based on your unique needs and chosen policy.

It’s always a good idea to shop around and compare quotes from multiple providers to find the best value and coverage tailored to your specific travel plans.

Comparing Travel Insurance Providers: Who’s got your back?

When it comes to choosing international travel insurance, you should know that not all travel insurance companies are created equal. It’s essential to pick a provider that’ll be your ride-or-die.

To help you make an informed decision, let’s compare two of my faves: World Nomads and SafetyWing.

We’ll break down what each company offers and doesn’t offer, and discuss which type of traveler would benefit most from each provider.

World Nomads: The Globetrotter’s BFF

- What they offer: World Nomads is a popular choice among adventurous travelers, and for good reason. Their comprehensive plans cover a wide range of scenarios, from medical emergencies and trip cancellations to lost or stolen personal items. They’re also well-known for their coverage of over 200 adventure activities, so if you’re a thrill-seeker, they’ve got you covered.

- What they don’t offer: While World Nomads does provide coverage for a vast array of activities, it may not cover specific high-risk sports or adventures. Be sure to check the policy details for any exclusions.

- Best for: World Nomads is an excellent choice for adventurous travelers who love to explore off the beaten path and participate in adrenaline-pumping activities. If you’re planning to go bungee jumping, scuba diving, or rock climbing, this might be the perfect provider for you.

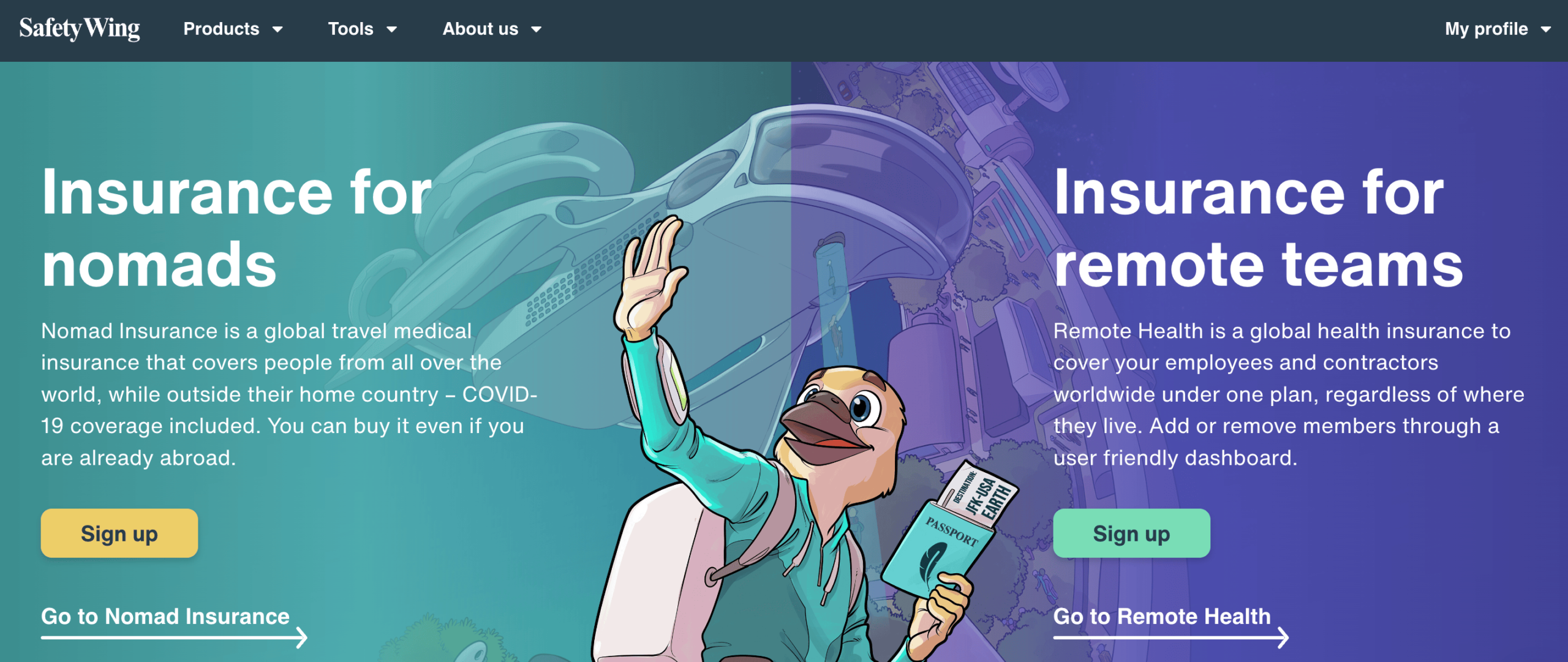

SafetyWing: The Digital Nomad’s Dream

- What they offer: SafetyWing is my top choice for digital nomads like moi. Their plans are tailored to meet the needs of location-independent professionals, offering comprehensive coverage for everything from medical emergencies to lost personal items, and even emergency evacuations (fingers crossed you won’t need that, though!). Their policies are flexible, allowing you to purchase and extend coverage while you’re already on the road. Plus, their customer service is top-notch – they helped me out when I had a minor scooter accident in Thailand (lesson learned: always wear a helmet, folks!).

- What they don’t offer: SafetyWing may not cover certain high-risk activities, so if you’re an extreme sports enthusiast, you’ll want to double-check the policy details. Additionally, their policies may not provide as much trip cancellation or interruption coverage as other providers.

- Best for: SafetyWing is ideal for digital nomads, remote workers, and long-term travelers who need flexible, comprehensive coverage that adapts to their ever-changing lifestyle. If you’re someone who’s always on the move, SafetyWing might be your perfect travel insurance match.

When it comes down to choosing the right travel insurance provider, it’s all about understanding your travel style, preferences, and needs.

By comparing customer reviews, financial strength, pricing, and flexibility, you can find the provider that’ll have your back through all your globetrotting adventures.

Evaluating Travel Insurance Policies: Reading the fine print (ugh, but necessary)

Once you’ve narrowed down your options, it’s time to channel your inner Sherlock Holmes and scrutinize those travel insurance policies.

Sure, it might not be the most thrilling part of planning your trip, but it’s essential to know what you’re signing up for.

Here’s a breakdown of what to look for in the fine print and why it’s crucial to read it:

Coverage limits: Each policy has maximum amounts they’ll cover for various benefits, such as medical expenses or trip cancellation. Make sure these limits are sufficient for your needs, or you could end up footing the bill for any costs that exceed the coverage amount.

Exclusions: Travel insurance policies often come with exclusions, which are specific situations or items that aren’t covered. For example, some policies may exclude coverage for high-risk activities or incidents related to alcohol consumption. Knowing these exclusions can help you avoid any unpleasant surprises down the line.

Deductibles: A deductible is the amount you’ll need to pay out of pocket before your insurance kicks in. Be sure you’re comfortable with the deductible amount, as it can impact how much you’ll ultimately be reimbursed.

Pre-existing conditions: If you have any pre-existing medical conditions, it’s vital to ensure they’re covered by your travel insurance policy. Some policies may require you to disclose these conditions and pay an additional premium for coverage.

Ask questions: If you’re unsure about any aspect of your policy, don’t hesitate to reach out to the insurance provider. They can help clarify any confusing terms or conditions, ensuring you fully understand the coverage you’re purchasing.

Let’s say, for example, you didn’t read the fine print and assumed your policy covered all adventure activities. While trekking in Peru, you decide to go paragliding, only to have an unfortunate accident that results in a hefty medical bill.

Later, you discover that your travel insurance policy excludes coverage for paragliding.

Yikes!

If you’d read the fine print, you could have opted for a policy that covered this activity or made an informed decision to skip it.

Reading the fine print may not be the most exciting part of your travel preparations, but it’s crucial for understanding the ins and outs of your travel insurance policy.

With this knowledge in hand, you can embark on your adventure with confidence, knowing you’re adequately protected for whatever twists and turns your journey may bring.

Tips for Purchasing Travel Insurance: The cherry on top of your travel cake

Ready to seal the deal on your travel insurance? Here are some handy tips to keep in mind to make the process a piece of cake:

Timing is everything: Purchase your travel insurance soon after booking your trip to ensure you’re covered from the get-go. Some policies even offer a short “sweet spot” window, during which you can snag extra benefits like pre-existing condition waivers or extra trip cancellation coverage.

Credit cards and travel insurance: Some credit cards offer travel insurance perks as part of their benefits package. Check to see if your card includes any coverage – it might save you some dough on purchasing a separate policy.

Health plans and coverage: Don’t rely solely on your health insurance or health plan from back home, as it might not provide adequate coverage for international trips or medical evacuations. Make sure your travel insurance policy supplements any gaps in your existing coverage.

Know your rights and responsibilities: Keep all your documentation handy, and familiarize yourself with the claims process in case of an emergency. Understanding your rights and responsibilities can help you make the most of your policy and avoid potential disputes with your travel insurance company.

Shop around for the best value: Use an online marketplace or comparison tool to weigh the pros and cons of various policies, providers, and coverage options. By shopping around, you can find the best value and type of coverage to suit your unique travel needs.

An Insurance Policy is Basically Your Travel BFF (Best Financial Friend)

In conclusion, my fellow wanderlusters, never underestimate the power of a trusty travel insurance policy. It’s like that cool travel BFF who’s always got your back, ready to swoop in and save the day (or your wallet).

Skimping out on travel insurance might seem tempting, but trust me, it’s not worth the gamble.

Before you jet off on your next adventure, take the time to shop around, compare policies, and find the perfect travel insurance sidekick for your unique needs. With the right coverage in place, you can truly embrace the spirit of adventure, knowing you’re protected no matter what curveballs the world throws your way.

Remember, the best travel memories are the ones without unexpected financial burdens or life-threatening surprises!

Thanks for reading!

Hi, I’m Tiana – founder of and author here at Where Tiana Travels. I’m a 20-something with a love for all things travel, photography, and food. I have been living abroad for the past 5 years and solo traveling the globe in my free time. I created this blog to share my travel stories and inspire other women to go out and see the world. Read more about me here!